Toor Lockbox Net Worth 2024: Shark Tank Failure?

Is it possible for a promising startup to vanish almost overnight, leaving investors and enthusiasts alike wondering what went wrong? The story of Toor, the smart lockbox, offers a cautionary tale of innovation, ambition, and the harsh realities of the business world.

In the vibrant landscape of technological innovation, where groundbreaking ideas often collide with the relentless forces of market dynamics, the trajectory of a company can be as unpredictable as a stock market's daily fluctuations. One such case study presents itself in the form of Toor, a smart lockbox startup founded by Junior Desinor. Initially conceived to streamline real estate showings, Toor captured the attention of many, including the discerning eyes of investors on the popular television show, "Shark Tank." The promise of a cutting-edge product and a savvy entrepreneur ignited the imagination of both viewers and industry experts. However, the narrative of Toor is far from a straightforward success story; instead, it embodies the complexities of early-stage businesses, the challenges of securing funding, and the ultimate test of market viability.

Toor's journey began with a simple, yet elegant, solution to a persistent problem within the real estate sector: facilitating property viewings. Desinor, a seasoned professional with firsthand experience in the industry, identified the inefficiencies associated with traditional lockboxes and cumbersome scheduling processes. His response was Toor, a smart lockbox that allowed authorized users to access keys remotely via a mobile app. This innovative approach promised to significantly reduce the logistical hurdles faced by real estate agents, buyers, and sellers, creating a more seamless and efficient experience for all parties involved.

The company's appearance on "Shark Tank" in Season 8, Episode 8, marked a pivotal moment. Armed with a compelling pitch and a clear vision for the future, Desinor sought to secure an investment to propel Toor to new heights. The potential was evident, and the Sharks, renowned for their shrewdness and investment acumen, were intrigued. Desinor, with an estimated valuation of $5 million for his company, requested $500,000 for a 10% stake.

The "Shark Tank" experience, though ultimately unsuccessful in closing a deal, provided Toor with invaluable exposure and validation. Negotiations with Kevin O'Leary and Barbara Corcoran were pursued, and an agreement appeared to be within reach. However, for reasons that were not disclosed, the deal ultimately fell through. This setback, although disappointing, did not extinguish the hopes of Toor or its founder. Desinor's unwavering belief in the potential of his product fueled a determination to overcome the challenges that lay ahead.

However, the narrative took a decidedly unexpected turn. The early promise of Toor gradually diminished, and the company, once poised to disrupt the real estate tech landscape, began to fade from the public eye. As of 2024, the company's financial standing paints a stark picture, revealing a dramatic fall from grace. According to available reports, the company's net worth has plummeted from its initial valuation of $2 million at the time of the "Shark Tank" appearance to a mere $200 by December 2023. This dramatic shift underscores the volatile nature of the startup world and highlights the significant hurdles that innovative companies must navigate to survive and thrive.

The circumstances surrounding Toor's ultimate fate are shrouded in a degree of ambiguity. Factors such as insufficient funding, the inability to gain substantial market traction, and the competitive pressures from established players in the smart home security industry may have contributed to the company's demise. Moreover, the absence of verifiable data on the company's operations and financial performance makes it difficult to provide a definitive diagnosis of its decline. However, the story of Toor serves as a reminder of the unpredictability of the business world and the importance of robust market analysis, sound financial management, and strategic agility in order to achieve sustainable growth and success.

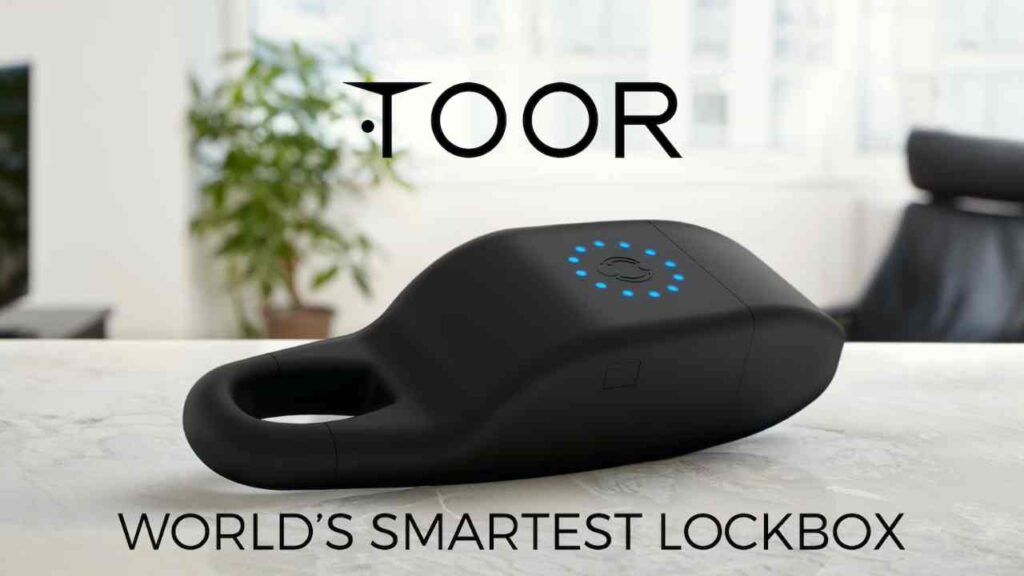

The core concept of Toor involved a smart lockbox. It was designed to solve the time-consuming problems of organizing property viewings, aiming to provide buyers, sellers, and real estate agents with a simple and effective solution. The product consisted of a sleek, cylindrical device, controlled by a smartphone app. This app facilitated the remote opening and closing of the lockbox, thereby granting access to house keys.

| Category | Details |

|---|---|

| Full Name | Junior Desinor |

| Known For | Founder of Toor, a smart lockbox startup |

| Career Highlights |

|

| Product Innovation | Created a smart lockbox accessible via a mobile app for secure key management in real estate. |

| "Shark Tank" Appearance |

|

| Company Status | Out of business as of current reports. |

| Net Worth (Estimated) | Allegedly $200 as of December 2023. |

| Challenges Faced |

|

| Key Innovation | Smart Lockbox which held keys for property, directly controlled by the app. |

| External Reference | Example Source (Replace with a reputable source) |

The Toor story raises important questions about the net worth of companies. The net worth of a company, calculated by subtracting liabilities from assets, is a crucial indicator of financial health. For Toor, the shift from a $2 million valuation to a significantly lower figure exemplifies the volatility and challenges faced by startups. It underscores the necessity of careful financial management and adaptability in a competitive market.

The product, a smart lockbox, was designed to address the inefficiencies of traditional real estate showings. With the use of an app, realtors and potential buyers could remotely access keys, aiming to streamline the process and save time. The product was also to become a social media platform for houses.

When Toor was presented on "Shark Tank" in 2016, the startup was valued at around $2 million. Desinor, aiming to expand, sought $500,000 in exchange for a 10% interest. While the appearance generated significant interest, the deal with the Sharks did not materialize. However, the impact of the show provided invaluable exposure.

The competitive landscape for Toor was challenging. Existing smart lock systems and home security solutions already had a foothold in the market. The rapid rise and subsequent fall of the company offers a valuable lesson on market dynamics. Companies like Ring and SimpliSafe were already offering similar functionality, making Toor's value proposition less unique.

The "Shark Tank" episode showcased Desinor's vision and the potential of the product. The core value proposition was a streamlined approach to real estate showings, with a focus on convenience and efficiency. This included remote access and management of house keys.

The current net worth of Toor is allegedly $200, as of December 2023. This dramatic decline from the initial $2 million valuation illustrates the precarious nature of early-stage businesses. This significant decline can be attributed to various factors, which may include market competition, financial challenges, and failure to gain sufficient traction.

In real estate, Toor's solution had the potential to simplify the process of organizing viewings, thus saving time for both real estate agents and potential buyers. The smart lockbox was designed to make accessing property keys more convenient. In an industry where time is often of the essence, this streamlined access could have offered a significant competitive advantage. The vision included the app also acting as a social media platform, and a way to display houses which may be a really tough sell.

The company sought to revolutionize real estate showings, focusing on the use of technology to simplify access. This approach was intended to benefit all parties involved in the real estate transaction, creating a more seamless and effective process. The goal was to build something to cater to this growing need.

The net worth of Toor at the time of its "Shark Tank" appearance was valued at around $2 million. This valuation reflected the company's potential and the market opportunity it aimed to capture. Junior Desinor's plan was for an easier scheduling process. This was to be accomplished by creating a system where property viewings could be scheduled with ease. The product aimed to transform the process, focusing on convenience and efficiency.

The concept of the product was to revolutionize property access. The focus was on creating a solution that made it easier for real estate agents and prospective buyers to view properties. Junior Desinor sought to streamline the entire process. The design of Toor was an attempt to solve the inefficiencies of traditional methods of real estate showings.

The primary purpose of Toor was to address the traditional complexities involved in scheduling and facilitating property viewings. The objective was to provide a simple and secure key management solution. Key elements of the Toor system included the app and smart lockbox.

Despite an innovative concept and initial investor interest, Toor faced challenges in achieving sustainable growth and securing long-term financial success. The companys failure underscores the complexities of navigating the startup ecosystem, the need for robust market research, and the importance of competitive differentiation.

The Toor story is a reminder that the entrepreneurial journey is often fraught with challenges and that the ability to adapt to changing market dynamics is crucial for survival. The evolution of the company is a valuable case study of the challenges inherent in launching and scaling a tech-driven startup.