Market Maker Insights: Analyzing Trading Strategies & ASCM's Role

Is the market a playground for the informed or a hunting ground for the unwary? Understanding the nuances of market makers, the entities that fuel trading activity, is crucial to navigating the financial landscape and avoiding potentially costly pitfalls.

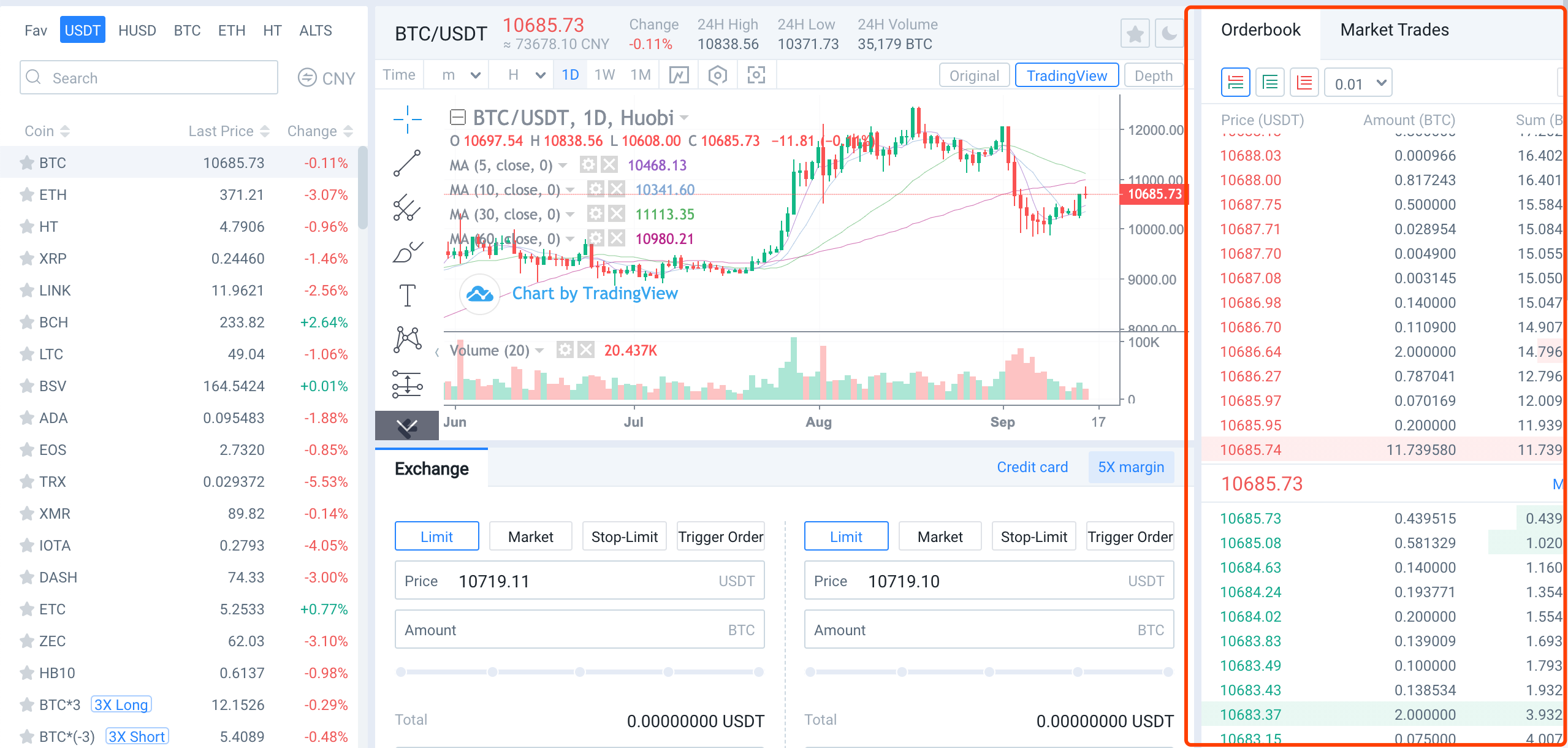

Traders, often driven by a mix of information and speculation, frequently react to news, rumors, or company filings, rushing to their trading screens to place orders. This immediate response underscores the fast-paced nature of modern markets, where information dissemination and interpretation are critical determinants of trading success. While this eagerness can lead to profitable opportunities, it can also expose traders to manipulation and exploitation, particularly from market makers. Level 2 data, offering insights into the order book, can be an invaluable tool for traders. However, its effectiveness hinges on understanding its complexities. Lack of comprehension can transform what initially seems like a promising strategy into a quick gain for those leveraging manipulative tactics.

Ascendiant's market-making and trading division, for example, utilizes its own capital to provide liquidity, facilitating trading in a wide array of equity securities. Their traders boast an average of over fifteen years of experience, offering reliable and efficient order execution. This extensive experience is invaluable in the volatile world of trading, especially when navigating the influence of market makers. Market makers play a crucial role in the market by providing liquidity and facilitating the buying and selling of stocks. However, their actions are not always transparent, and their incentives may not align with those of the average trader. By understanding market maker behavior, traders can better assess risks and opportunities.

The actions of market makers are frequently discussed in the context of market manipulation. For example, if a market maker is "soaking up size" on the bid, they could be accumulating shares, potentially signaling a level of support and a bullish outlook. However, it's equally important to recognize that market makers can also short sell a stock, profiting from a downward price movement. The presence of certain market makers, such as ASCM, is often associated with volatility and short-selling activity. ASCM, in particular, is frequently cited in discussions about market manipulation, with some accusing them of creating artificial price corrections after a stock experiences a significant upward movement. This can result in a "scare" and trigger a price correction, allowing the market maker to profit. Understanding these tactics is critical to making informed decisions.

The market maker's behavior is often stock-specific, as is the impact of order flow, often a blend of institutional and retail activity. In many cases, institutions and retail order flow can be represented through a mix of entities such as INTL, NITE and GTSM. This complexity highlights the dynamic interplay of different participants in the market.

For the average trader, the ability to distinguish between legitimate market activity and potentially manipulative behavior can be challenging. While it is not possible to prove it definitively, some traders speculate that market makers may engage in practices like "selling naked" into a run-up, only to then "reel it in" for a buyback at a lower price. This is another instance where vigilance and an informed approach are essential to success. The markets constant evolution means that staying informed about the strategies and tactics of market participants is important.

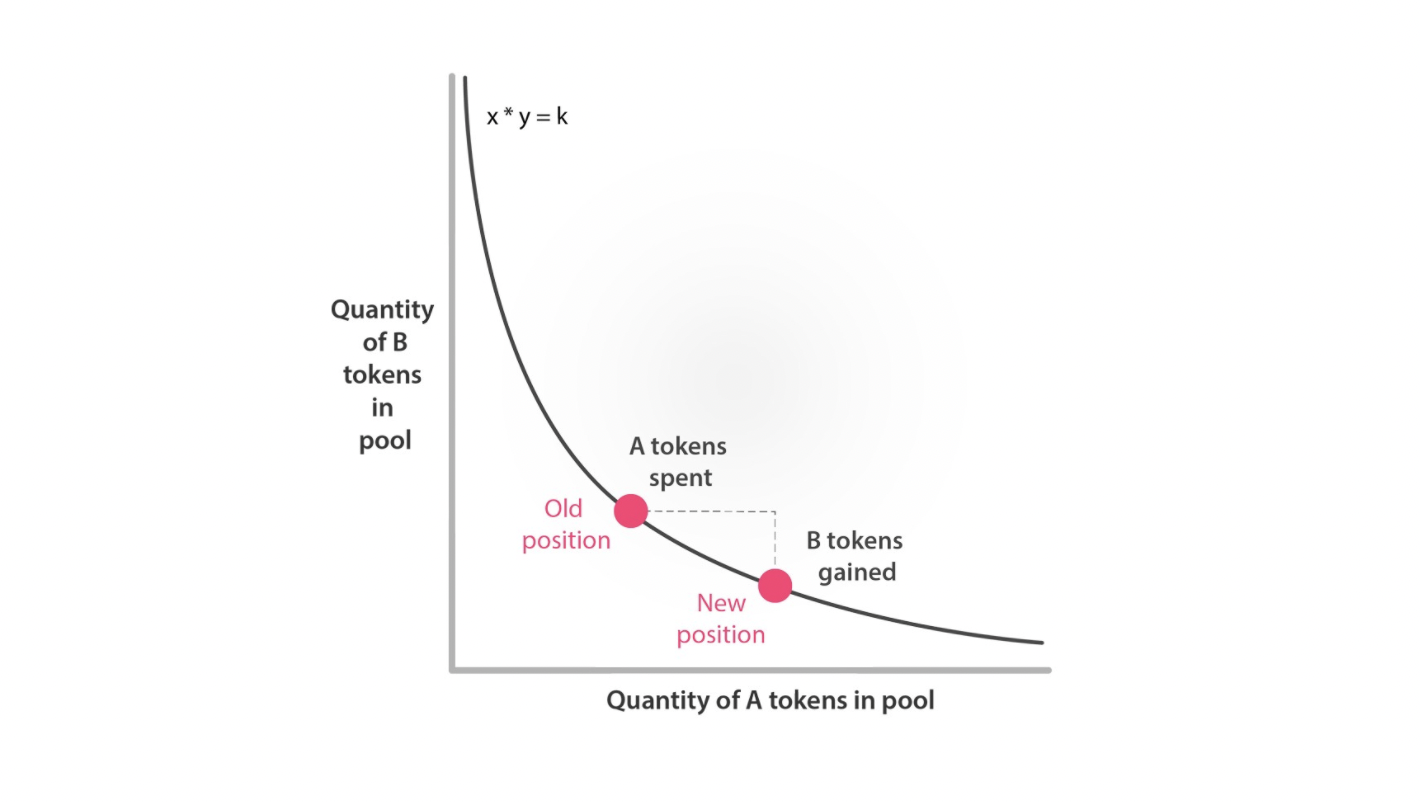

Market makers, as liquidity providers, are crucial for efficient trading, particularly during periods of high demand. They serve to prevent trade halts and ensure continuous price discovery. The concept of market making extends beyond the realm of stocks, as highlighted by the certifications offered by APICS (CPIM/CSCP/CLTD). These certifications facilitate career advancement in the supply chain field and offer the opportunity to increase earning potential, focusing on logistics and inventory management.

Market manipulation is a recurring theme, especially in the realm of OTC markets. Instances like the influence of ASCM on the trading activity, where it is alleged to have engaged in strategies that impact price movements. Recognizing these influences and staying informed about market dynamics helps you navigate this environment more effectively. Being aware of the potential tactics used by market makers is an essential step in informed decision-making. Its very important to stay informed and alert and the same can be done through continuous reading and analysis.

Let's consider a hypothetical individual deeply entrenched in the world of finance:

| Category | Details |

|---|---|

| Full Name | Alexandra "Alex" Sterling |

| Date of Birth | July 15, 1978 |

| Place of Birth | New York City, USA |

| Nationality | American |

| Education |

|

| Career Highlights |

|

| Professional Affiliations |

|

| Key Skills |

|

| Notable Achievements |

|

| Website Reference | CFA Institute |

This table provides an example of how information might be presented in a clear and structured format for a professional or a person of interest in a news article. Each category is listed with specific data points that are important to the background of the person, in this case, Alexandra Sterling. A table like this provides an easy way to convey detailed information and is useful for organizing various types of information such as biographical details and key professional accomplishments.

The financial markets operate under a complex set of rules and regulations. Market makers are required to provide liquidity, but this role can sometimes overlap with other activities. The presence of market makers in the ask can also create a sense of artificial scarcity that can be exploited.

The information provided is for informational purposes only, and should not be considered financial advice.